Try Getsitecontrol for free

Build unique, professional-looking forms for your website.

![5 Lessons for Your Next SaaS Pricing Model Change [Getsitecontrol Case Study]](https://assets.getsitecontrol.com/prod2/blog/customer-engagement/saas-pricing-model-change/cover.png?width=640&rev=da3f99bd6b)

If you’re a SaaS company owner, changing your pricing model will not be your favorite part of the job. We know that from experience.

First, you’ll have a hard time figuring out the best model and the right strategy, and even after making the best-you-can-think-of decision, you'll probably still have some customers who are unhappy with your decision.

Things may get messy, but that doesn’t mean you shouldn’t do it. Changing your SaaS pricing model is only natural because as your service evolves, it's normal for your pricing to evolve as well.

Over a period of 20 months, we’ve changed Getsitecontrol's pricing three times. Technically, we went from a per-feature SaaS pricing model with a free plan to a usage-based SaaS pricing model with a 7-day trial.

Here is the evolution of our Pricing page recreated step by step:

August 2017 – February 2019

Per-feature SaaS pricing model + free plan.

February 2019 – April 2019

Usage-based pricing + 7-day trial.

April 2019 – November 2019

Usage-based pricing + 7-day trial (lower entry threshold).

The lower entry threshold from the last adjustment helped us get the following results within just a couple of months:

1.5X average user lifespan increase

2X purchase conversion rate boost

Want to know the details? Below, we’ve shared five key takeaways from our experience. By sharing how we made our decisions, we hope that small and medium SaaS vendors like ourselves can make the process of changing pricing strategies a bit less painful and a lot more productive.

Without further ado, let’s dive right in.

When you’re changing your SaaS pricing model, it’s tempting to ask your customers what price they would be comfortable with. However, as we already know from the Mom’s test, most questions starting with “Would you…” tend to bring false positives, and you risk coming to the wrong conclusions.

If you want to collect meaningful data, you need to skip the fluff and ask specific questions.

So, instead of nudging customers into making false promises, consider using the Van Westendorp price sensitivity meter (PSM) to verify your assumptions about the right price tag.

The Van Westendorp meter is essentially a chart built on survey results. The survey includes four simple questions:

At what price would you think this product is a good value?

At what price would you think the product is getting expensive?

At what price is the product so inexpensive you doubt its quality?

What price would you think is too expensive for you to consider buying the product?

And because your goal is to eliminate random useless data, you may want to provide respondents with predefined options.

Van Westendorp survey helps you find the price range acceptable for your customers.

Publish the Van Westendorp survey on your website or right in your cloud app at the early stage of the research. Once you collect the responses, you’ll be able to define an acceptable price range and the optimal price point according to your customers’ perceptions.

Keep in mind that the Van Westendorp model will only work when the respondents are familiar with the product and able to provide experience-based opinions.

If only there was a proven way to know whether the new pricing would bring more revenue than the current one!

Clearly, there is a lot of guesswork here. The only feasible method we’ve found is by comparing customer lifetime value for both models after introducing the new pricing. Below we’ll explain to you how it works.

Customer lifetime value (CLV) is the net profit contribution of a customer to the business over time.

To calculate the average CLV, you need to multiply average customer lifespan by the average purchase value.

The lifespan formula goes as follows:

If you don’t know your churn rate, it’s easy to calculate, too.

Churn rate is the percentage of business subscribers who discontinue their subscriptions within a given time period.

To find your churn rate, track how many customers purchased in two sequential payment periods and divide that by the total number of customers who bought in the first period only.

Say, you have a monthly subscription service, and you need to calculate your average monthly churn rate. In the first month, you had 100 paying customers. Only 60 of them extended their subscriptions for the second month. This way, your churn rate will equal (100 — 60)/100. Or 40%.

Now you should be able to quickly figure out your current CLV because you have all the data for it. And here comes the tricky part. How do you calculate the new CLV if you don’t know the churn rate for the new pricing?

Well, you can’t. Not yet.

Although you can always build assumptions, the surefire way is to wait for at least two subsequent payment periods after introducing the new SaaS pricing model and repeat your calculations.

Remember that if you keep the old pricing for your existing customers, you should only include the number of new customers in the formula. This transition method is called “grandfathering”, you’ll read more about it in a couple of paragraphs.

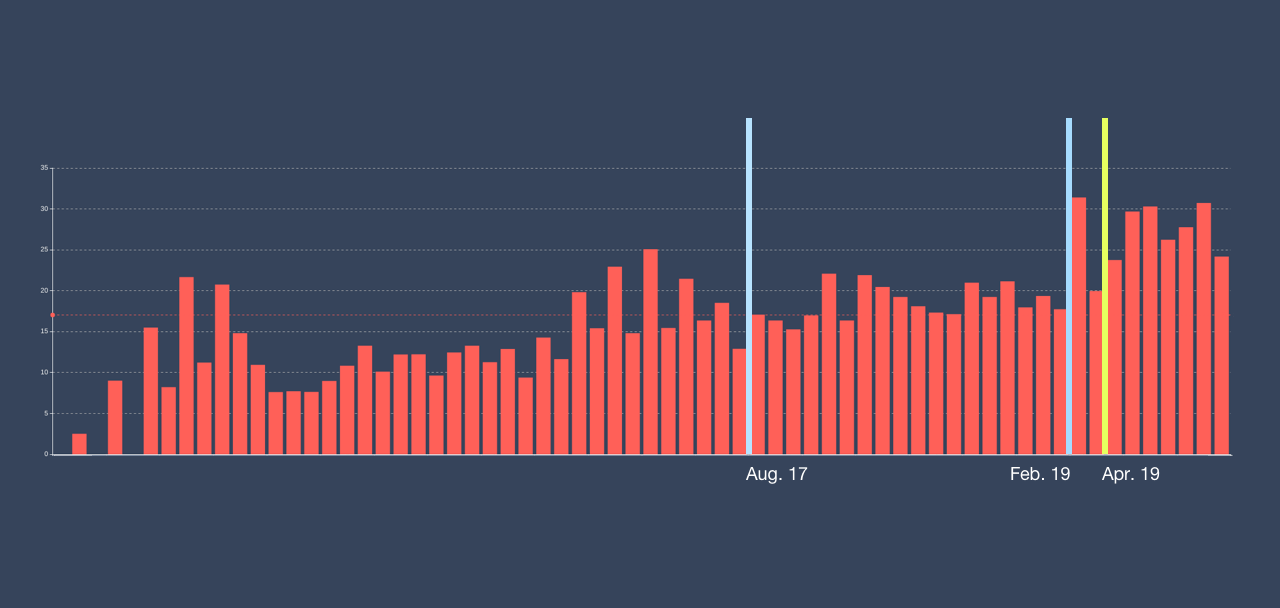

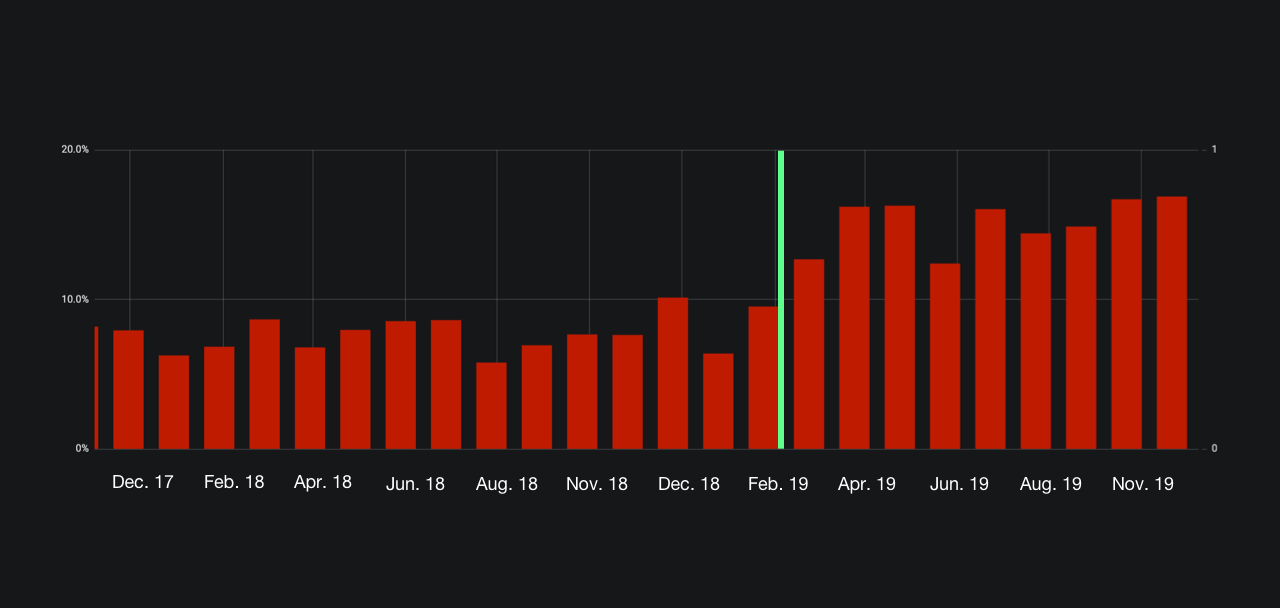

To verify this approach, we manually calculated lifespan and churn rate for every Getsitecontrol account ever registered and then compared the results to the ones based on the formula.

Not only did we validate the formula, but we also confirmed that the new SaaS pricing model works well for us. Notice how the graph shows that Getsitecontrol’s average customer lifespan nearly doubled after the new pricing had been introduced.

The solution is not perfect and will perform better for services with short-term subscriptions, obviously. For example, if you sell monthly subscriptions, you’ll be able to see whether the new model was the right decision as early as two months after changing the price. And if you discover it isn’t – there’s still time to make adjustments or even go back to square one and start from scratch.

For example, take this case study by Canny, a feedback management tool that changed its pricing model four times over a year.

Once you make the big decision about your new pricing, it’s time to decide whether you will transfer your existing paying customers to the new model or if you'll only apply the new prices for new customers.

Historically, there are three ways to handle it:

Grandfathering

This means you’ll guarantee the same price to all existing customers either forever, or for a certain period.

Transfer discount

This smooths the transition process for existing customers but still moves them to the new pricing.

Direct price increase

In this case, you choose to make the price equal for everyone right away — your currently paying customers and new users — justifying the move by the service update.

Each approach has its advantages, but the choice typically depends on the level of loyalty your customers have towards your brand. As a comparatively young company, we see grandfathering as the most viable strategy and believe it’s always better to avoid upsetting those already paying for our service.

According to Profitwell, grandfathering is also the most popular price increase methodology used by 46% of SaaS companies.

On the other hand, brands confident in their customers’ loyalty are more likely to choose the third option without worrying about losing a large chunk of their audience. Consider Netflix, which has been increasing its subscription price by $1 every year since 2014 and seems to be doing just great in terms of revenue.

The success of your new SaaS pricing model partially depends on the efficiency of your communication strategy. And when you’re ready to announce the pricing change, the right time and the right words are crucial. This is why you should start planning your message well ahead to make sure both your team and your customers are fully informed and prepared.

There’s no perfect time to change the price of your product, but there are times you certainly want to avoid. Those are slow periods (such as summer) and crowded periods (such as Black Friday). The former won’t allow you to collect sufficient feedback from customers, and the latter will bring tons of new customers with a short lifespan. Both will shift the perspective and lead to misjudgment of the new model. We suggest choosing the most neutral month for your business – perhaps, somewhere around February or March.

Complaints about price increases are magnified when your existing customers feel that you're “springing” the new prices on them. To avoid this, inform your existing customers about the upcoming move well in advance to let them prepare.

Your existing customers should know about the update before you publish an official announcement on your website and change your pricing page. Consider sending out a newsletter, placing notification bars in their admin dashboards, or making a post in a private group on social media.

In the ideal scenario, along with the details, you should provide the reasons behind the change, especially if it’s a noticeable price increase. Here is a great example by Tim Soulo, the CMO of Ahrefs. When the Ahrefs team decided to eliminate the free plan, he published the following message in a private Facebook community:

By posting this on Facebook, the company shows 100% transparency and willingness to answer questions. What’s interesting though, is that in the comments, you see more support and encouragement than disappointment. Why? Probably because the justification part is communicated perfectly, too.

Sometimes, after introducing the new model, you see that things don’t turn out the way you expected.

For instance, when we eliminated the free plan, both signup and purchase conversion rates dropped more than we had anticipated. Of course, we expected a certain decrease from the effect of switching from freemium to a trial. But apparently, the $19 entry threshold was still way too high for the small and medium business owners we target.

And here is why entry thresholds are tricky. When you increase an entry threshold, it hits the smallest customers the most. For cloud apps like ours, that can be a large number of paying small businesses who may potentially grow into larger businesses and upgrade to more expensive plans. On the other hand, you don’t want to make your entry threshold too low either because some may start doubting the quality of your product.

With that in mind, two months later we reduced the entry subscription plan from $19 to $9. And here is an interesting thing. Due to the $9/month subscription plan, we were able to lower the churn rate and consequently increased the average lifespan of each customer.

In the end, despite the price drop, our customer lifetime value grew because more people were comfortable with the commitment.

Whether you’re increasing prices or changing your SaaS pricing model completely, it’s critical to set markers that will show whether you’re moving in the right direction. And if you want to minimize the guesswork, allocating enough time for research is key. Use proven formulas and price sensitivity surveys to build your assumptions but prepare a detailed plan B in case they fall short.

Once you make the change, pay attention to data and customer feedback and don't be afraid to change again if the numbers make sense.

If all goes well, you'll be able to keep your customers happy while improving your bottom line.

Nina De la Cruz is a content strategist at Getsitecontrol. She is passionate about helping small and medium ecommerce brands achieve sustainable growth through email marketing.

You're reading Getsitecontrol blog where marketing experts share proven tactics to grow your online business. This article is a part of Customer engagement section.

Main illustration by Icons8Email forms, promos, coupons, surveys, bounce-stoppers.

Get started, it’s free →Subscribe to get updates

Get beginner-friendly tips for growing your online business.